Intensifying trade disputes (US-China, US-Europe), the Brexit, reduced economic growth expectations, but also new production technologies demand a review of your company’s global/regional manufacturing footprint. BCI Global presents 4 takeaways. Current growth expectations, geopolitical challenges, intensifying trade disputes (US-China; US-Europe), labor market challenges, changes in investment climates in key countries around the world: the need for a more focused corporate investment strategy and the continuous drive for cost effective manufacturing plants, require companies to have a clear global/regional manufacturing footprint strategy, including high quality manufacturing locations in regions that are attractive for the longer term.

Besides the uncertainties mentioned above, also technological innovation is pushing both product development as well as manufacturing process development fast forward. For one of our recent clients on the high tech side of medical devices this led to scenarios in which its products in the future will be much more modular, with standardized components that can be configured in different ways to make the unique final product. Johan Beukema, Partner at BCI Global: “Because of this standardization it will also become much more feasible for this company to use new production technologies. Longer-term this will support the move from labor-intensive production to a much more automated process in the factories. In this specific project this meant analyzing scenarios in which the production time per unit was reduced by 80% and the labor cost component was reduced by over 60%. Obviously, in these scenarios the optimal locations were not the lowest-cost locations in e.g. Asia and Latin-America but the higher cost locations in the center of the company’s most important markets in North-America and Europe”.

BCI Global is supporting companies around the globe in the optimization of their manufacturing footprints. Our approach is based on thorough mathematical modeling combined with qualitative (e.g. business climate, labor market) and risk analyses. It is the combination of “the numbers”, practical realities and forward thinking that makes our approach unique.

Based on this recent experience 4 takeaways can be defined:

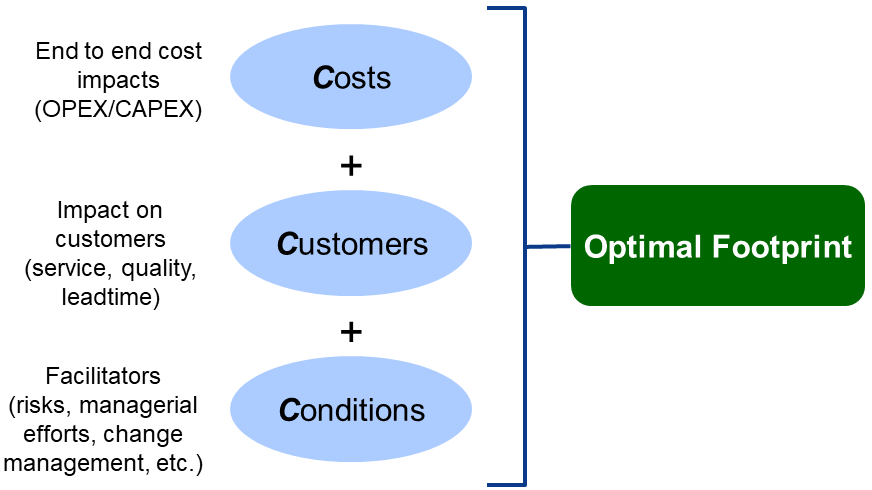

BCI’s approach takes into account the 3C perspective: Cost, Customer and Conditions. Cost factors include e.g. labor, facility, transportation, capital, etc. Customer factors are e.g. lead times, service levels and delivered quality and Conditions are factors such as management complexity, risk of change and cost of change.

Clients often focus primarily on the cost-side of the equation. Costs are “easily” calculated and people are used to communicate in numbers and currencies. In our daily practice we however show our clients that the optimal cost scenario is not always the longer-term optimum for the company from a strategic business perspective.

Mathijs Pronk, senior consultant gives an example: “Recently we identified a significant cost opportunity for a company, moving production volumes from East-Coast China as well as from the United States into an existing manufacturing plant in Mexico. However, when analyzing the labor market in detail in that particular Mexican region it became clear that the company would run into huge shortages already within a two-year time frame. The final solution therefore was to optimize the allocation of capacities over the optimal locations per continent rather than centralize at a global level”.

Three types of scenarios can be distinguished: current context scenarios; drastic scenarios; bandwidth scenarios.

The current context scenarios show a company until which point in the future the current set-up is still feasible (“when will it break?”). The drastic scenarios illustrate theoretical optimum (“white sheet of paper approach”), disregarding the reality of existing legacy infrastructure, customer agreements, etc.

The real answer typically is in the bandwidth scenarios. In these scenarios the reality of the current footprint is optimized in the direction of the most promising drastic scenarios, taking into account boundaries for optimization because of legacies, business strategy, regulatory developments, etc.

Especially in the current times of geopolitical uncertainties risk factors cannot be assessed only at a very high level. Factors such as political, financial, economic but also natural disaster risks must be an integral part of the analyses.

Johan Beukema: “Trade tensions between the US and China but also the Brexit make some locations more risky than others. But we have also seen factories that were located right in the middle of a high risk tornado (US) or flooding (Central Europe and Asia) area. By creating a detailed risk profile of existing and potential candidate locations, a company can make a fact-based decision on which locations match with the company’s level of risk acceptance”.

The result of a manufacturing footprint optimization analysis typically is a detailed, executable footprint program including a clear roadmap. This roadmap includes strategic initiatives that will take a long period to implement and require significant investments. Examples are e.g. new plants in new geographies, plant closures and significant automation projects. However, the roadmap also includes optimizations that are easier to implement, that companies can start up on the short term and that will lead directly to results. Mathijs Pronk: “Clients are often pleasantly surprised by the identified ‘low hanging fruits’. These are found in e.g. simple changes in purchasing rules (i.e. reducing the number of deliveries from suppliers), outbound distribution consolidation or even outsourcing of a simple activity. These short-term results can also be a means to finance the more strategic initiatives“.

During the last 18 months BCI Global observes a huge uptake in the number of companies that are initiating significant manufacturing footprint initiatives. The increased interest of companies to seriously review their global footprints is driven by a combination of factors including the uncertainties in the geopolitical landscape, the serious pressure on labor markets across the globe, technological innovation and the ever continuing pressure on costs.

For more information please contact Johan Beukema, Partner or Mathijs Pronk, Senior Consultant.