China’s size, economic growth (despite Covid-19) and fast development of internet sales are unique in the world. More and more people buy online: today 35% in China is e-commerce sales, expected to increase to ~65% over the next 3 years. This means that the e-com channel strongly develops and this requires another product to market approach.

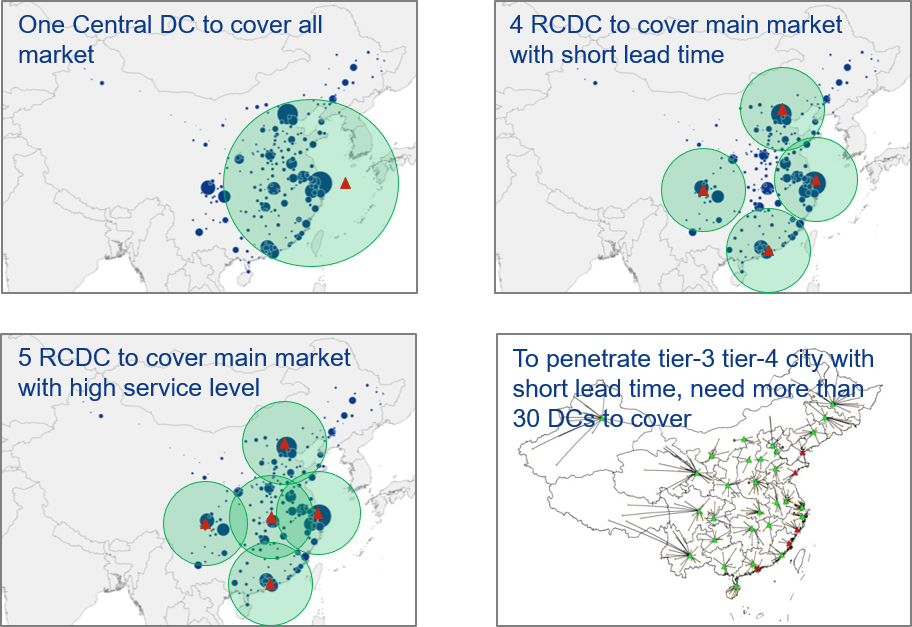

To deal with higher demand volatility and shorter lead times (same day/next day), e-commerce channels require an expanded logistics network with higher levels of safety stock at more distribution centers. Where traditionally companies wanted to reach distributors in China in a few Tier-1 cities, the need has now become to penetrate more and smaller cities with a short lead time. E-commerce companies such as Alibaba, JD.com and Tencent have become market leading e-com companies by offering the networks that meet the new consumer requirements. Brand owners have two choices to adapt to the new reality; either they create an own dense network of DCs combined with quality parcel providers for the final mile, or they ‘tap into’ the networks of above-mentioned e-com companies. Cost wise an appealing approach, but it creates more distance between the brand owner and its customers.

Next to the e-com developments and the additional channels this creates, the traditional channels can’t be ignored. Distributors, traditional retail, department stores and pop-up stores are still in the network but accept longer lead times and lower shipping frequencies.

Concluding: there is clearly not one size that fits all in the China market, but a mix of different structures is required to create a distribution network that fits all needs. This makes distribution network design complex and therefore requires a different approach.

Source: BCI Global, 2020

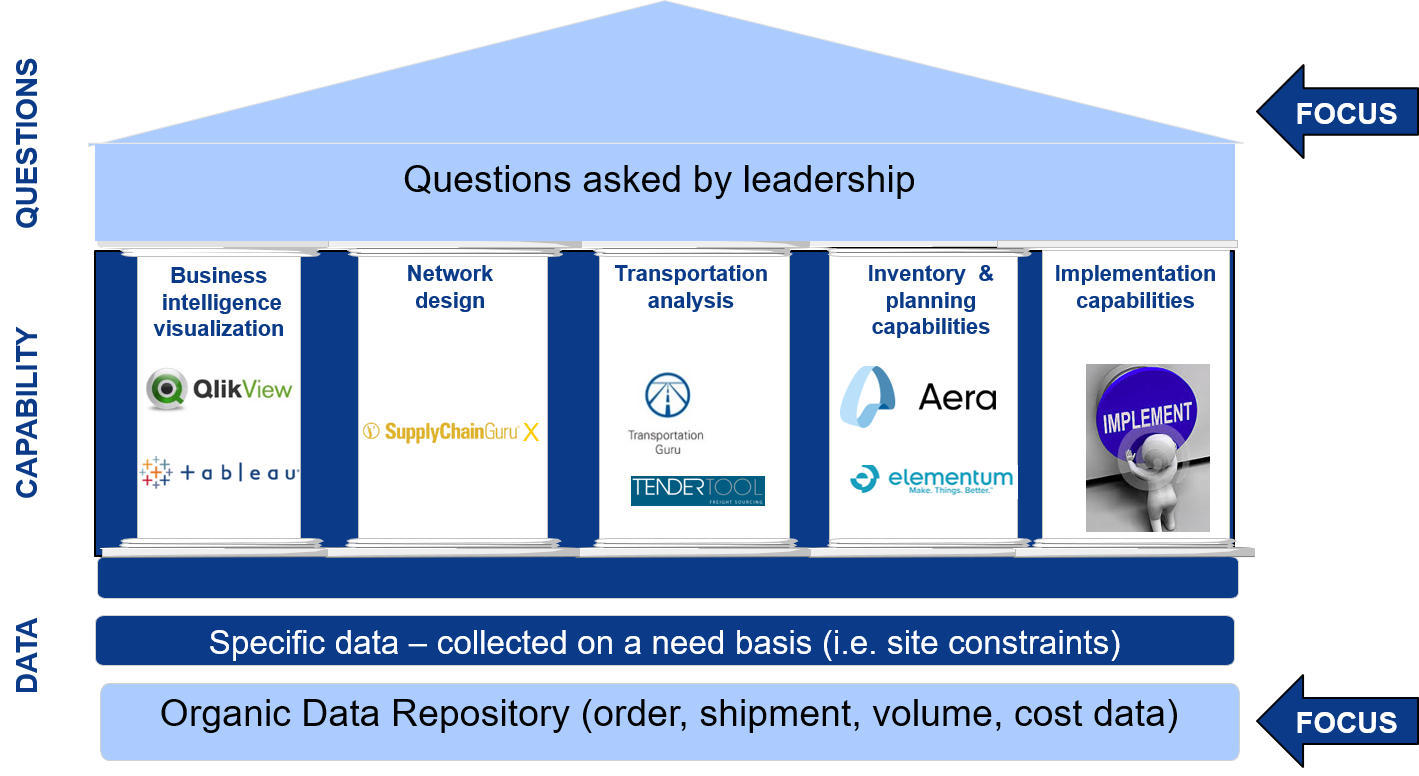

The customer service strategy of a company defines the different frequencies and service levels that apply in each channel. For example, weekly to distributors, daily to e-com platforms and next day to consumers buying online. As a result of the e-commerce boom and growth, it is important to go from a static network design (once per 3 years in Europe) to a more continuous approach for China. Obviously, in such approach the frequent collection of logistics data must be a lean exercise. This can be achieved by embedding the repetitive analysis in a logistics ‘Center of excellence’ (COE) of an organization and work with a digital replica (‘twin’) of the supply chain. The COE means a fixed team of logistics experts working on continuous logistics optimization and improvement. A digital twin is a set of models allowing quick ‘what-if analysis’, based on a data repository that is continuously held up-to-date with the relevant customer data.

Source: BCI Global, 2020

The focus of the COE is the ‘ground layer’ of the data repository but also the questions of leadership that need to be answered. Questions can be operational (what is the impact of a potential strike?) as well as strategic of nature when related to required network changes. Realizing strategic supply chain changes takes time. For example, the change of the location of a Central Distribution Center requires a solid business case and a significant preparation and implementation time. It is therefore key to have a logistics agenda for strategic logistics changes.