These are some of the conclusions of two studies Buck Consultants International / BCI Global, one of Europe’s leading supply chain logistics and location/real estate consulting firms publishes this morning. One study is a survey amongst Europe’s leading logistics real estate developers, investors and experts; the second study consists of a survey among pan-European tenants of warehouses (shippers, logistics services providers). The study focuses on 11 countries and 27 logistics hot spots.

** Download the full presentation below **

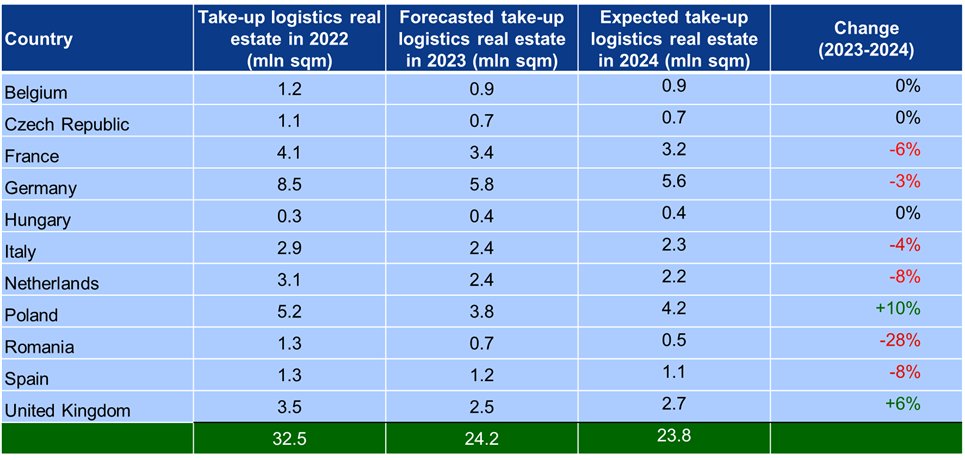

European take up (11 countries) is expected to be more or less table (-2%) in 2024 after a 2023 which showed an unseen decrease in take-up of 26% compared to 2022. The logistics real estate markets in Spain, Netherlands and Romania are doing poor, while Poland and the UK are doing relatively well. See table 1.

Table 1. European overview take-up volume (mln sqm)

Source: Buck Consultants International, 2024

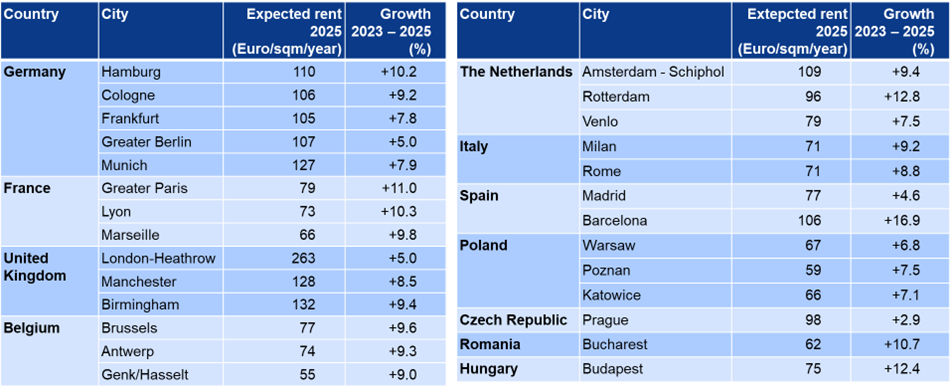

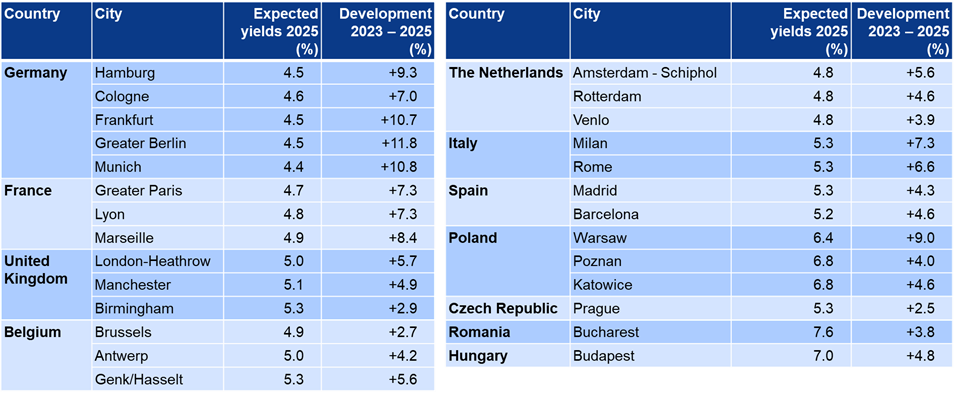

Rent levels will be up with an average 10% in 2025 compared to 2023, but with substantial differences between countries and between regions within a country (see table 2). Net prime yields will be between 4.5% and 5.5% in 2025 on average, showing uncertainties in the markets (see table 3). But the developers, investors and experts expect that logistics real estate will stay an attractive asset class.

Table 2. Prime warehouse rents per city - growth expectations 2023-2025

Source: Buck Consultants International, 2024

Table 3. Net prime warehouse yields per city - expectations 2023-2025

Source: Buck Consultants International, 2024

Half of the tenants of warehouses all over Europe expects that the availability of warehouses workers will become THE most important location factor for a distribution center in the next 3 years. Obviously, with labour shortages all over Europe, they expect substantial labor costs increases, particularly in Poland, Hungary and the Netherlands. Tenants are prepared to pay higher operational costs if labour dependency reduces by warehouse automation.

For more information:

René Buck | Email: rene.buck@bciglobal.com

Carlo Peters | Email: carlo.peters@bciglobal.com