India is known for its highly complex tax regime in the past. Under the country’s reform spearheaded by Mr. Modi, the current prime minister of India since 2014, India has revolutionized their complex tax structure with the introduction of Goods & Service Tax (GST). This change is highly welcomed by foreign investors. In last 5 years, there are new foreign direct investments into India. The biggest changes are seen in business and their supply chain models.

GST has brought in ‘one nation one tax’ system to remove the issue of double taxation, layers of taxes, and states wise different tax structure, but its effect on various industries is slightly different. The first level of differentiation is depending on whether the industry deals with manufacturing, distributing and retailing or is providing a service. GST is applicable on goods and services at the place where final/actual consumption happens I.e. the consumer and collected at each stage of sale or purchase in the supply chain. The manufacturer or wholesaler or retailer will pay the applicable GST but can claim back through tax credit mechanism. So ultimately the GST will be paid by the consumer. BCI Global has developed a strong practice in supporting companies in supply chain reforms and strategies.

Business Transformation Ideas Under GST = An opportunity to transform your business

Why look at business

All these will need a relook in the GST era, when business priorities are likely to win over tax priorities as taxes will be more or less equal in all situations.

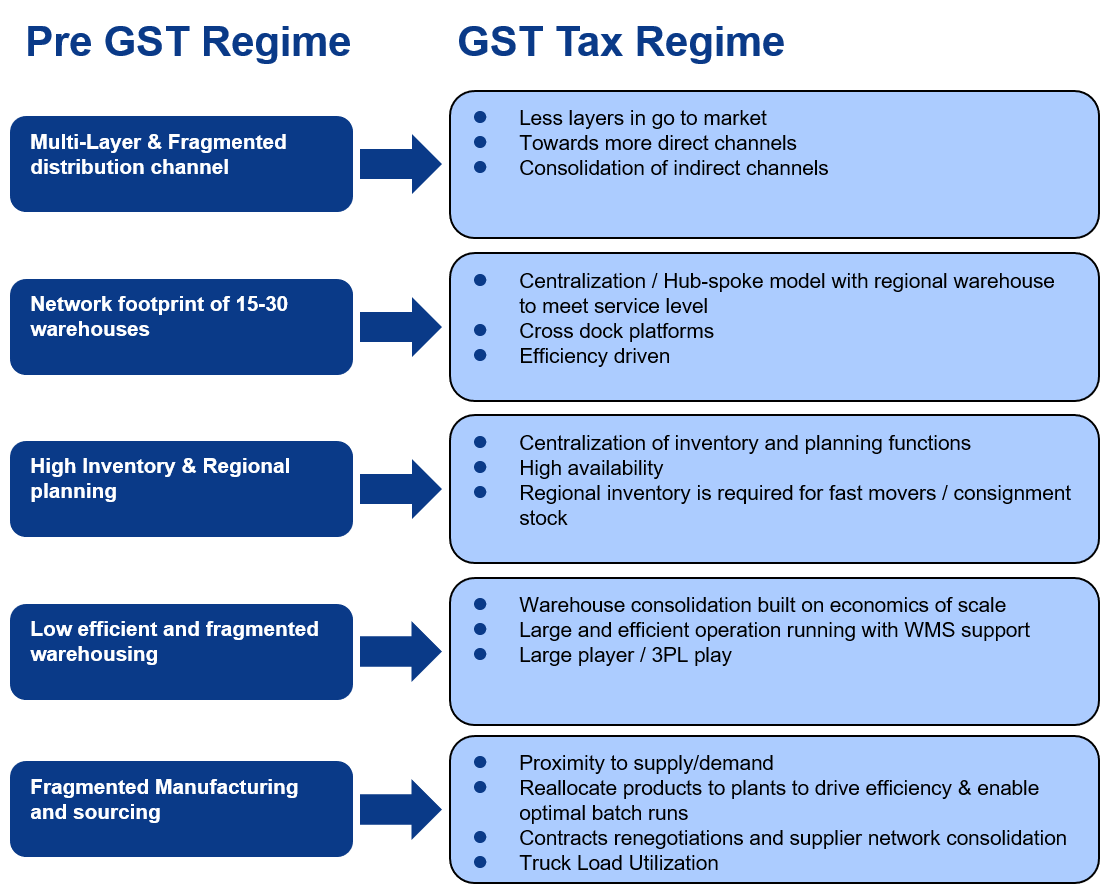

GST Regime will impact at all stages of product transformation i.e. from Point of Production (PoP) to Point of Sale (PoS). With GST rollout, distribution area will be a key area to optimize for cost reduction and operational efficiencies.

Many businesses started restructuring their operations in light of GST:

The impact for Multinational Companies in India is different on an individual company basis. BCI encourages companies to revise the Indian business and supply chain set up. The key focus areas for transition can include:

Mapping “As Is” scenario, assessing the fiscal impact of GST on various business verticals and analyze “What If” scenarios.

Finalizing a detailed implementation plan to execute and monitor key tasks such as service provider selection, IT implementation and supply chain related changes.

Design an operating model considering supply chain network changes. BCI has a detailed presentation available on Indian supply chain dynamics including the GST regime and impacts to supply chains. Download the presentation.

BCI Global has proven methodologies to help businesses in impact assessment and reforming the supply chain consist of: