News

57 found items

News

06 June 2025

Transport Rates Face Shifts Amid Economic and Regulatory Pressures

Transport rates across Europe and global freight markets are set for nuanced changes, according to the 13th BCI Transport Monitor

News

28 May 2025

How to structure your Supply Chains in India?

India is changing rapidly. It is extremely important for companies to take note of the changing landscape and adapt their Distribution Strategies to ensure their continued success in this key market

News

28 April 2025

BCI Global recognized as one of America’s Best Management Consulting Firms

The well-known business magazine FORBES has recognized BCI Global in its annual overview again as one of America’s Best Management Consulting Firms – for 7 years in a row and as only specialized independent supply chain & site selection advisory firm!

News

14 April 2025

First Person: René Buck, President & CEO, BCI Global

René Buck has spent the last four decades helping global companies choose where to build. As founder and CEO of BCI Global (Buck Consultants International), he’s led location strategy, site selection projects and supply chain projects across Europe, Asia, and the Americas. He launched the Netherlands-based firm on the same day he received two un...

News

07 April 2025

Is Your Supply Chain Network Ready for Tomorrow’s Customers?

Global trade and tariff uncertainties, shifting consumer demands, and rapid tech advancements make supply chain networks both critical and vulnerable. Yet, a BCI survey of over 240 logistic VPs and Directors across the U.S. and EU found only a minority of companies regularly review and optimize their networks, leaving most unprepared for disrupt...

News

02 April 2025

5 Myths About Forecast Accuracy

Demand forecasting is a crucial component of supply chain management, helping businesses plan inventory, production, and distribution effectively. Many companies strive for higher forecast accuracy, believing it to be the key to improving service levels and reducing costs. However, misconceptions about what forecast accuracy truly means and how ...

News

21 March 2025

Master data, often overlooked but not to be ignored

Master data plays a key role in processes and supports decision making. Why do many companies not have a robust process, governance and resources tied into good master data management? Not paying enough attention to master data management leads to people chasing data, wasting time and effort on doing manual rework and to drawing wrong conclusion...

News

12 March 2025

New BCI Global Report: No visibility – No resilient supply chain

Only 1 out of 3 companies have the right information about their end-to-end supply chain to review and optimize their global supply chain and manufacturing footprint networks. The other 65% drive in the dark in a turbulent time with global disruptions occurring and emerging

News

15 January 2025

Frank Hofstee has joined as Partner Supply Chain Advice

Being able to contribute to the further expansion of BCI Global in my new role as partner is a great challenge. This firm has an excellent reputation

News

06 January 2025

'Dynamic' science park sector growth driven by quest tor talent

Prospects for the science park sector are good, driven by demand from startup companies looking for thriving R&D environments inhabited by like-minded people

News

11 December 2024

We are Partners! But are you really?!

We are here to dive into the world of partners in the business environment. With a CMO, with a packaging company, with your logistics provider. The question here is: what is real partnership, what is the essence of true partnerships, and why do we seek business partners?

News

05 December 2024

BCI Global's Transport Monitor

Road and parcel transport costs on the rise again with gross rate increase expectations of 4-7% for road and 5% for parcel next year. Ocean freight and air freight remain very volatile, according to BCI Global’s Transport Monitor

News

05 December 2024

Søstrene Grene selects Venlo, The Netherlands as location for their new distribution center

Danish home decoration retailer Søstrene Grene has selected Venlo, the logistics hotspot location in The Netherlands, as the location for their new distribution center of 45.000 sqm

News

04 December 2024

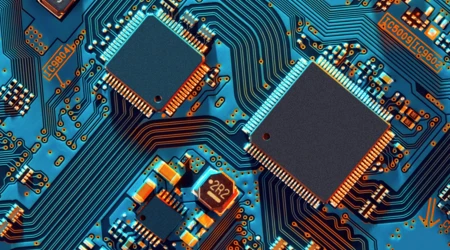

Semicon Investments Surge

Demand for chips will undoubtedly accelerate in the future. But how to guarantee risk-free supply? And what does that mean for the strategy of individual semiconductor companies?

News

04 December 2024

Coping with Rising Trade Tariffs

Trade restrictions are on the rise all over the world. President Trump will probably give a push to higher import tariffs, provoking retaliation measures of other trading blocs like Europe and Japan.

News

28 November 2024

Forbes Magazine recognizes BCI Global as one of the best consulting firms in the world 2024

The renowned international business magazine Forbes Magazine has announced that also this year the economic, logistics and location consulting firm BCI Global is one of the best consulting firms in the world.

News

29 October 2024

Logistics operators now have sustainability firmly on the agenda

ESG factors play an increasing role in the logistics industry and in the logistics real estate markets. But it is not only about the E of Environment.

News

29 October 2024

Supply chain executives’ ambitions extend further than end-to-end visibility

Only less than 30% of the internationally operating companies currently have end-to-end supply chain visibility. This is one of the surprising results of a survey of BCI Global and Supply Chain Media among leading supply chain executives.

News

31 January 2024

Logistics real estate markets in Europe are expected to stabilize in 2024 after very disappointing 2023

After a sharp decrease in 2023 with 26% of the take up of logistics real estate in 11 European markets, the take up in 2024 will stabilize. This is one of the conclusions of two studies Buck Consultants International / BCI Global published this morning.

News

15 December 2023

Carbon Border Adjustment Mechanism (CBAM): Why? How? What?

The EU’s Carbon Border Adjustment Mechanism (CBAM) is a tool to put a fair price to the lifecycle of carbon intensive goods imported into the EU. As per October 2023, CBAM imposes a reporting obligation and carbon tax for companies importing designated goods, full implementation expected on January 1st, 2026.

News

04 December 2023

24 for ’24: Emerging Tech Hubs Around the World

In an exclusive report, the expert team at Netherlands-based BCI Global takes a close look at two dozen ‘out-of-the-box’ cities for future software development and support centers.

News

17 November 2023

European road and parcel freight rates will increase with 8% in the next six months

European road and parcel freight rates will increase with 8% in the next six months. Global ocean freight rates are stable at low level, but air freight rates will further decrease with another 5%. These are one of the main conclusions from the Transport Monitor of leading supply chain and logistics consulting company BCI Global. For t...

News

28 September 2023

Reshoring to US and Europe accelerates, now also serving CO2 emission reduction objectives

Reshoring accelerates as American and European companies want to de-risk their supply chain from geopolitical developments and supply chain disruptions. This concludes supply chain and location strategy consulting firm BCI Global in a very extensive study (supported by SCM).

News

21 September 2023

Forecast: More Regional R&D Centers in Europe, North America and Asia

The next years more companies will set-up R&D centers in the major regions of the world (e.g. Europe, North America, Asia). This expectation was presented at the World Conference of the International Association of Science Parks (IASP) in Luxembourg by René Buck, CEO BCI Global.