Cases

79 found items

Case

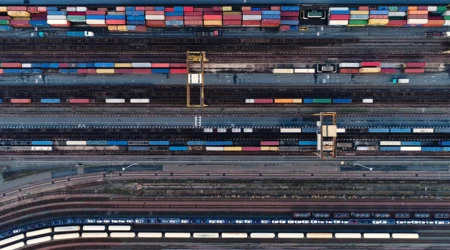

INDIGO+

What is the feasibility and impact of three innovations in rail freight transport in the Netherlands: automatic brake control, train monitoring and digital automatic coupling (DAC) on the shunting, loading and unloading process.

Case

RH2INE location study

The international community is strongly committed to the development of hydrogen as a fuel for various modalities. This is corporated in among others the EU Green Deal. For the use of hydrogen in inland navigation, the RH2INE program is a concrete initiative to this end. As a start of the European RH2INE program, a study was initiated to prepare...

Case

Effect of Demurrage and detention costs on modal choice

Shippers and logistics service providers have to pay detention and demurrage fees to shipping lines when a container is not brought back to the shipping lines after the contractual negotiated number of free days. These detention and demurrage fees can quickly go up to hundreds of dollars per container when the number of free days is surpassed. I...

Case

Amsterdam Logistics Center

CTPark Amsterdam City will comprise of 120,000 sq m Lettable Floor Area (LFA) and will be located right in the heart of the Netherlands’ excellent infrastructure and holds a pivotal location in one of the most densely populated areas in Europe. CTPark Amsterdam City is strategically located in the Port of Amsterdam, the 4th busiest cargo port in...

Case

Feasibility study Blue Gate Antwerp

This study analysed what the opportunities are for the development area Blue Gate in Antwerp, and what type of companies can locate here with a specific focus on city logistics. The BCI study concluded that there are many development options for Blue Gate Antwerp.

Case

Surflogh (European Level)

Objective of the project is to achieve a more efficient cargo distribution in urban areas, and thereby maintain efficiency in long distance transport. To promote efficient logistics sustainably, the focus is on optimizing the interaction between hubs and the urban logistics system in smaller and medium-sized cities and city networks.

Case

Carbon Footprinting of intermodal European corridors

Starting up and profitably running intermodal corridor transport services requires a lot from companies: it takes time and requires relatively high investment costs. A high occupancy rate of multimodal transport service is essential to work in a structurally profitable manner. The Joint Corridors Off Road program supports logistics service provi...

Case

Strategic development plan for the multimodal infrastructure at Port of Moerdijk

The Port of Moerdijk has developed in recent years into an important logistics and industrial hub in the Netherlands with a strong bond with 'big brother' Rotterdam. The location on deep sea water offers a range of multimodal connections via maritime shipping, flanked by inland shipping, pipelines, rail and road transport. The port of Moerdijk h...

Case

Potential for a hydrogen hub Scheldt-Delta region

Smart Delta Resources, a collaboration platform including companies such as Air Liquide, Air Products, ArcelorMittal, Dow, ENGIE, Fluxys, Gasunie, North Sea Port, Ørsted, PZEM, Vopak, Yara, Zeeland Refinery and Vopak.

Case

‘Cost-to-serve’ analysis modelling

Develop a cost to serve analytics model to reflect the total landed costs in the supply chain including order handling, order management, distribution, fulfilment, packaging, inbound, sourcing and planning, using big data.

Case

Validating the control tower strategy

Validate the control tower strategy for a large industrial manufacturing company and support the outsourcing process to select multiple LLPs.

Case

Truck Platooning

Data sharing in logistics and in traffic management is becoming more and more important. To support the development of efficient logistics and traffic management with data sharing the OpenTripModel (OTM) was developed as an open data model used to exchange logistics trip data via the web. The OTM makes it possible for transporting companies to i...

Case

Transport and carrier optimization

The customer is a large manufacturer of bulk and packaged chemicals with a sales volume exceeding 2 billion euros, transport flows from 8 plants and 9 warehouses to over 12,000 ship-to locations all over Europe. The transportation budget reaches 25 mil.

Case

The most attractive operating model for Insourcing versus outsourcing decisions

Make or buy assessment for various geographies across the globe including APAC to assess whether the brand owner should insource or outsource the activities in the market place taking into consideration the growth and availability of providers in the respective territories.

Case

The best third party logistics (3PL) in warehouse and distribution

Select the best 3rd party logistics provider (3PL) for warehousing and distribution for a FMCG company which fulfils requirements related to food safety, compliance and integrity, relevant experience, industry knowledge, cultural fit, commitment and costs.

Case

Targeting the logistics sector for new investments in Belgian Limburg

Locate in Limburg is a regional development organization focused on attracting foreign investments. One of their main targets is logistics. Within the logistics sector several target groups are relevant: dedicated logistics companies (3PL’s), but also manufacturing companies that are looking for a warehouse to deliver to European stores or end c...

Case

Supply chain strategy for a fast moving consumer goods company

Create a vision and a supply chain strategy for a fast-moving consumer goods player for multiple geographies, i.e. EMEA, the Americas and APAC.

Case

Supply Chain Center of Excellence (CoE) Implementation

Support the client in developing an analytical Center of Excellence, train the COE team members and identify, lead, conduct and implement supply chain analytical projects within the COE.

Case

Strategic economic plan for the city center of Rotterdam

BCI has been asked to develop a new strategy for the economic activities in the city center of Rotterdam, as part of an integrated spatial economic masterplan.

Case

Site selection for a production plant in Asia

What is the optimal location for a new production plant in Asia? BCI conducted a comprehensive and independent location comparison for the new manufacturing plant of this company in Asia-Pacific.

Case

S&OP planning framework for Integrated business planning

BCI conducted a Sales & Operations assessment to determine key gaps in processes, organization and systems. BCI developed a customized S&OP blueprint and supported the implementation process focusing on creating the engagement and alignment between stakeholders and the actual implementation.

Case

Post-merger supply chain integration in the medical devices sector

BCI was hired as a project leader to conduct two tasks: manage and support the supply chain integration of the two companies at multiple production locations, including the setup of shared services, the export of pharmaceutical products from multiple sites via a 3PL, the integration of both order management processes, and the implementation of a...

Case

Positioning strategy of Birmingham for higher added value front and middle office projects

In recent years Birmingham has been successful in attracting a number of foreign companies performing higher value added front and middle office activities within business, professional and financial services to locations within the city center Enterprise Zone. Key examples include Deutsche Bank, Hogan Lovells and HSBC. These types of operations...

Case

New mainport strategy development for Amsterdam Schiphol Airport

What is the economic importance of the Schiphol region for the Dutch economy, how are the economic activities of the airport network related to the region and what is the optimal strategy for Schiphol Airport to collaborate with companies in the region and outside for sustainable economic growth?