05 December 2024

BCI Global's Transport Monitor

Road and parcel transport costs on the rise again with gross rate increase expectations of 4-7% for road and 5% for parcel next year. Ocean freight and air freight remain very volatile, according to BCI Global’s Transport Monitor.

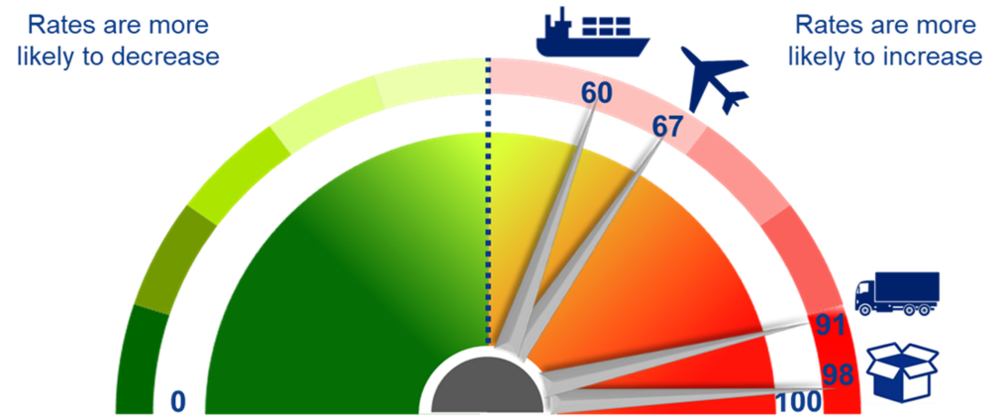

Freight Managers Index: When above 50, rates are likely to increase

Source: BCI Global

European road transport

Despite lower short-term demand, particularly in sectors like retail and automotive, rates are still expected to rise significantly in 2025 (FMI 91). Rates are expected to increase 4-7%, driven by structural cost increases, including higher labor expenses, energy transition costs, insurance, and ongoing driver shortages. These elevated operational costs continue to push freight rates upward, even amid reduced demand.

Ocean freight

The Freight Management Index (FMI) of 60 suggests that rates are expected to rise, but high vessel capacity means the typical end-of-season rate increases may be smaller than usual. The outcome of the US elections most likely will lead to a surge in imports, driven by anticipated tariff hikes (FMI was calculated pre-elections). From a service perspective, the new Gemini alliance between Maersk and Hapag Lloyd, launching in February 2025, will result in fewer port calls per service, which should work out positively for the reliability of Ocean transport.

Air freight

An FMI of 67 indicates rates are expected to further increase. Air freight rates are anticipated to stay higher than usual (mainly from Asia) as demand outpaced capacity growth, mainly due to high e-commerce volumes. Airlines have contracted over 80% of their capacity to (Asian/Chinese) e-com companies. Shift of Ocean to Air (due to disruptions in ocean freight) and global uncertainties play an important role as well.

Parcel

With an FMI-score of 98, a significant increase of parcel rates is expected across the board. Expectations are that domestic parcel rates will increase with 4% and cross border parcel rates with approx. 5.5%. On top of this general rate increase, accessorial costs are likely to increase, or new surcharges will be introduced leading to higher overall transport costs. Like road transport, all related costs are increasing, and driver availability is particularly challenging in the parcel sector. In addition, significant investments are required to make parcel distribution more sustainable.

Summary and recommended actions

European Road and Parcel

- Transport rates of Road and Parcel are going north due to taxation, inflation and lack of drivers

- Companies need to make steps forward in logistics procurement and negotiations, as well as in other cost saving opportunities in order to off set the expected rate increases

- Recommendation: benchmark current rates and selectively tender the larger opportunities. Explore alternative solutions such as:

̵ Lead time relaxation

̵ Avoiding Cross border parcel and by direct infeed models

̵ Trying to set up round-trips and LTL for larger groupage pallet shipments

̵ Review and re-negotiate accessorial costs

̵ Collaborative procurement with other companies to create procurement leverage (this can be done on all modes of transport)

̵ Re-assess whether you have the right footprint in place

Global Air and Ocean

- Air and Ocean are at a higher level than 1 year ago, with expected further increase of rates

- Recommendation: benchmark your current rates and only tender specific opportunities

- Keep a clear view on the new Gemini alliance

If you would like to know more about the BCI Transport Monitor, want get access to the webinar recording, or need help to reduce your freight bill please contact one of our related contacts below.