For most companies clearly the time has come to take a longer-term perspective again and prepare the company for potential new disruptions in the future. BCI Global has defined 5 strategic initiatives that companies should adopt when preparing the manufacturing footprint for the future:

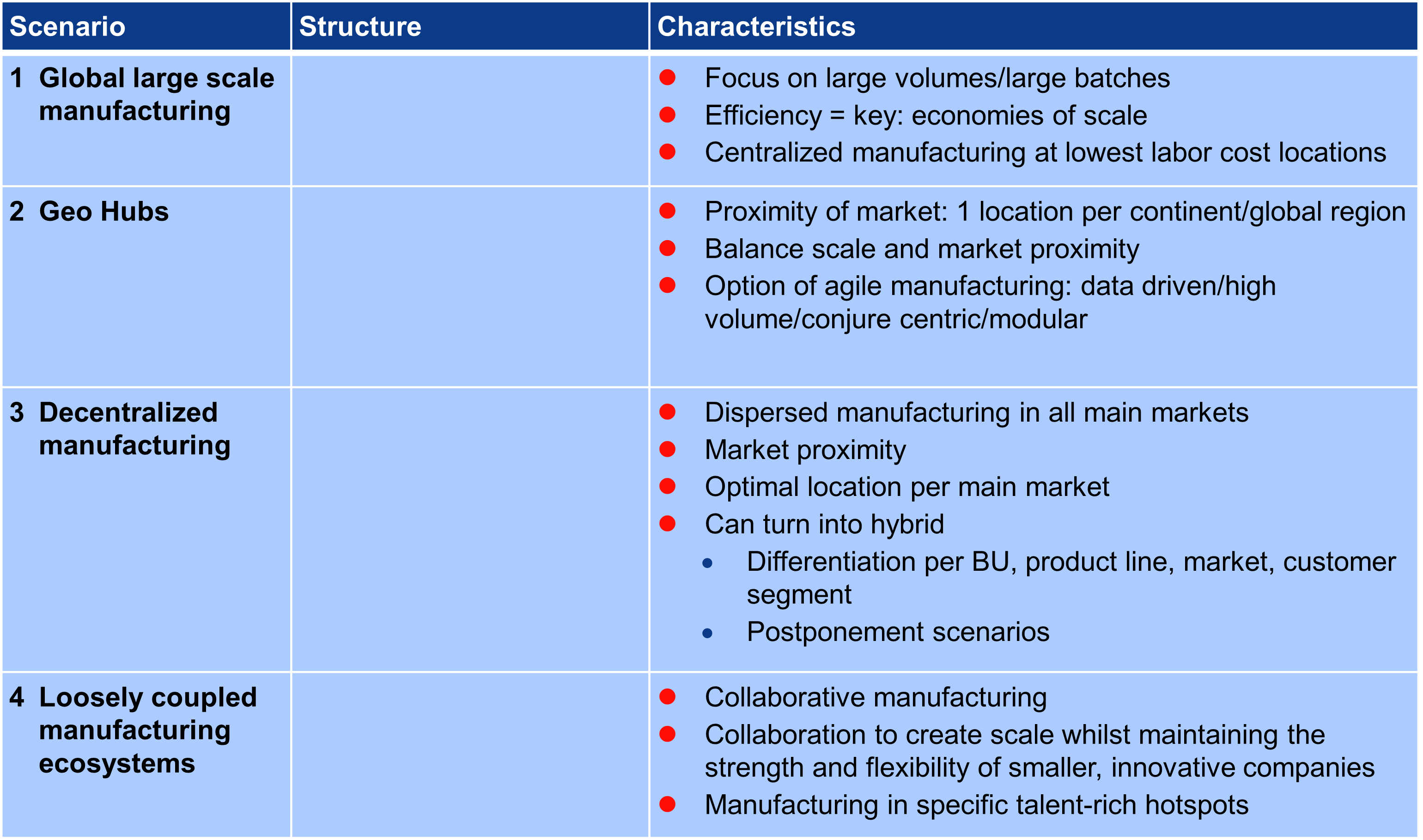

In the last 18 months a lot has been published about the concept of reshoring of manufacturing meaning relocation of manufacturing capacity that has been brought previously to low cost locations in, for example, China back to the home country in Europe or North America or close to the home country in those regions (near-shoring). Some authors expressed an expectation of a significant spike of reshoring projects. Recent experience and research of BCI shows that the reality is different per geography. In Europe no significant reshoring activity is observed yet, whereas reshoring to North America (including Mexico) is taking off in higher numbers. Furthermore, BCI practice shows that it is not so much real reshoring that companies will take action on. Rather, a lot of companies with a global footprint are looking at optimizing their footprint and are taking a close look at decentralization scenarios.

Practical examples of decentralization scenarios from BCI’s recent practice are presented below.

|

Case 1 - European industrial company with a legacy manufacturing footprint of multiple plants in Europe and Asia and with each plant focusing on a specific technology/product line. This company, driven by the need to become more resilient to deal with disruptions around the globe, now starts to implement a decentralization strategy, aiming to create a network of regional plants around the globe, each serving autonomously their own region (Americas, EMEA, APAC). BCI analyses showed that this new strategy will lead to a slightly higher cost base which is accepted by the company’s management as this cost increase is off set by the significant increase in resilience. |

|

Case 2 - Fast-growing US-based medical device manufacturer with a highly outsourced Asia-centric supply and manufacturing base. This company is facing steep growth in the coming years and therefore has a need to expand the manufacturing capacity significantly. The company’s C-level challenged the operations team to build the end-to-end supply chain for the future balancing capacity expansion, cost control and security of supply. As a result of detailed scenario analyses supported by BCI the company now starts to implement a structure with regional assembly plants and supply ecosystems. |

It must be mentioned that decentralization will not work for all companies as there are also clear barriers, such as availability of the right labor pool, supplier networks, proximity to high growth markets, regulations, etc.

Focus on core competences has already for a long time been a key driver for outsourcing manufacturing activities in for example high tech companies such as Cisco and Apple. These companies hardly do any manufacturing steps in-house anymore. The same trend can be observed in the pharmaceutical industry.

Driven by the challenges of today’s global context (trade barriers, pandemics, natural disasters, further sharpening of market expectations) BCI acknowledges a trend of companies looking for the optimal balance between in-house and outsourced manufacturing. So not “either, or” but rather “and, and” defining in detail which technologies/capacities to keep full control of in internal operations and which to run in more flexible outsourced structures with specialized, long-term partners.

Similar to the decentralization trade off, also here costs are not the only driver. Companies should really look for the balance of costs, control (quality, compliance, management) and flexibility.

|

Case 3 – Global life science diagnostics company. This company historically mainly had manufacturing in-house but acquired two companies in the past 10 years with a significant outsourced manufacturing base. After several years running these combined networks in parallel the company decided that a more strategic view on Make versus Buy was required. Based on BCI in-depth analyses and advice, the company is currently developing the future network with a rebalanced combination of specific core technologies, including new product introductions (NPI), in a limited number of internal Centers of Excellence and a much more scalable outsourced footprint around that for high volume production. |

Whether manufacturing is in-house, outsourced or a combination of both, the overall supply chain of almost all manufacturing companies includes significant external suppliers and service providers.

The last years have made many companies realize that they do not have a good visibility on what is happening in the external part of their supply chains, both upstream and downstream. Besides that, companies have also learned that in case they would have had the visibility, they still would not have had the systems and organization in place to act upon events happening in the supply base.

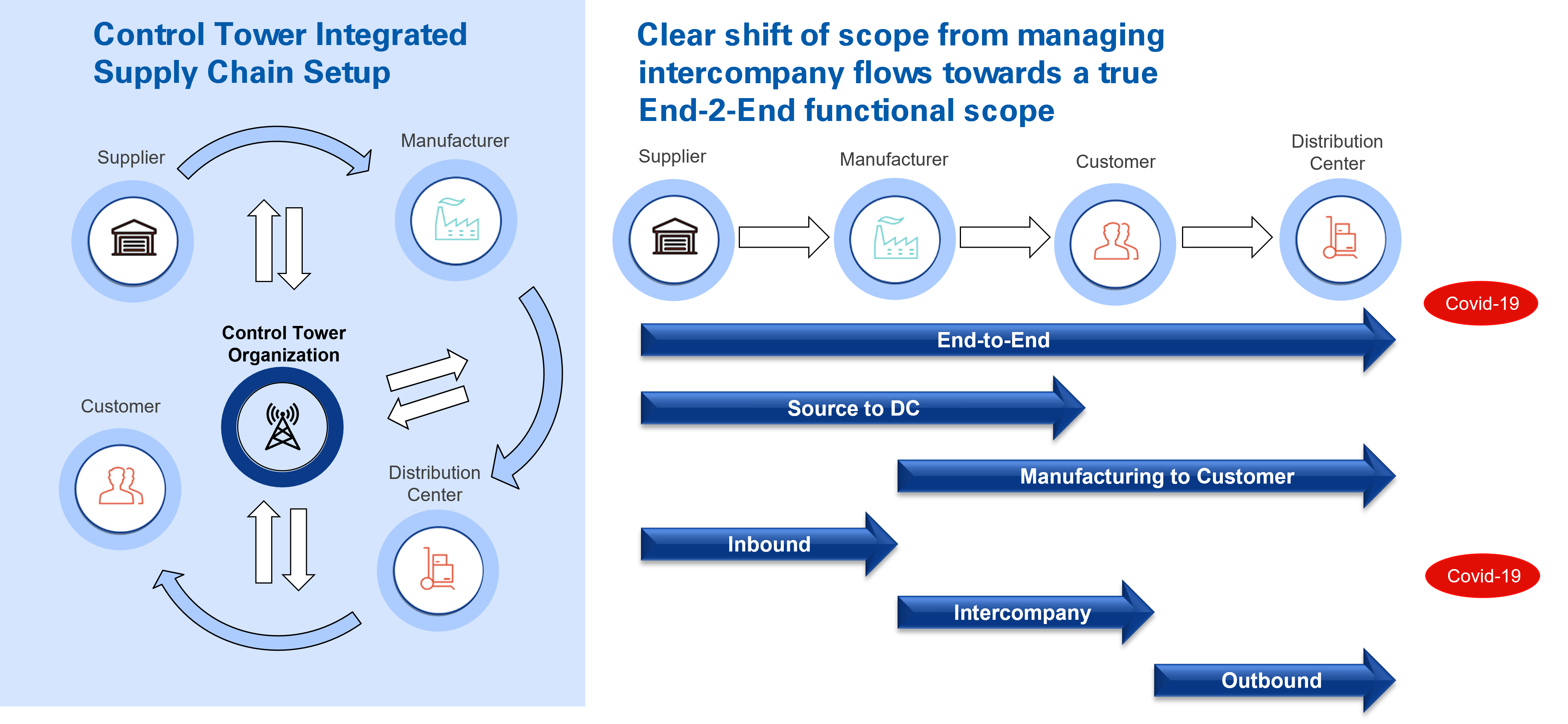

Therefore, companies must now focus on implementing a structure (organization, processes, systems) to create more visibility and to act upon this visibility in practice. Actions that companies are taking are for example to implement extended control tower solutions (see visual) and digital twins.

Also companies can differentiate more in their supply base: deciding which suppliers are really critical for the business and building strong partnership models together with them whereas other levels of suppliers may be managed more from a transactional perspective. Key is to manage the whole ecosystem of the company’s supply chain as one system and not as separate pieces: each supply chain is as strong as its weakest link. Control Tower solutions to manage the end-to-end supply chain

Another strategic direction for manufacturing companies to increase their footprint resilience is to make effective use of new manufacturing concepts and technologies.

Industry 4.0 concepts including additive manufacturing, virtual/augmented reality, highly automated manufacturing processes will have an impact on the future manufacturing footprint.

One aspect companies should take a closer look at is the potential for further automation/robotization in their manufacturing processes. Often the labor component of manufacturing is a barrier to footprint changes. This is either because there is not enough labor (quality and quantity) available at alternative locations or because of the costs of labor, for example when decentralizing towards locations closer to key markets, are just too high to justify the business case. Further automation/robotization can be an effective strategy for becoming less dependent on labor and therefore being able to make other decisions in the manufacturing footprint. BCI sees in its client base that also the pandemic has been a driver here: lower dependency on labor also means lower risk of plant shutdowns in the case of a pandemic outbreak.

Another aspect of manufacturing technology strategies is the move towards more continuous and flexible manufacturing set-ups. Amongst others the pharmaceutical industry is moving more and more from batch manufacturing to more flexible and continuous manufacturing set-ups with fast turnarounds of production lines from one product to another, decreasing the costs of downtime significantly while increasing flexibility to react to changes in the market.

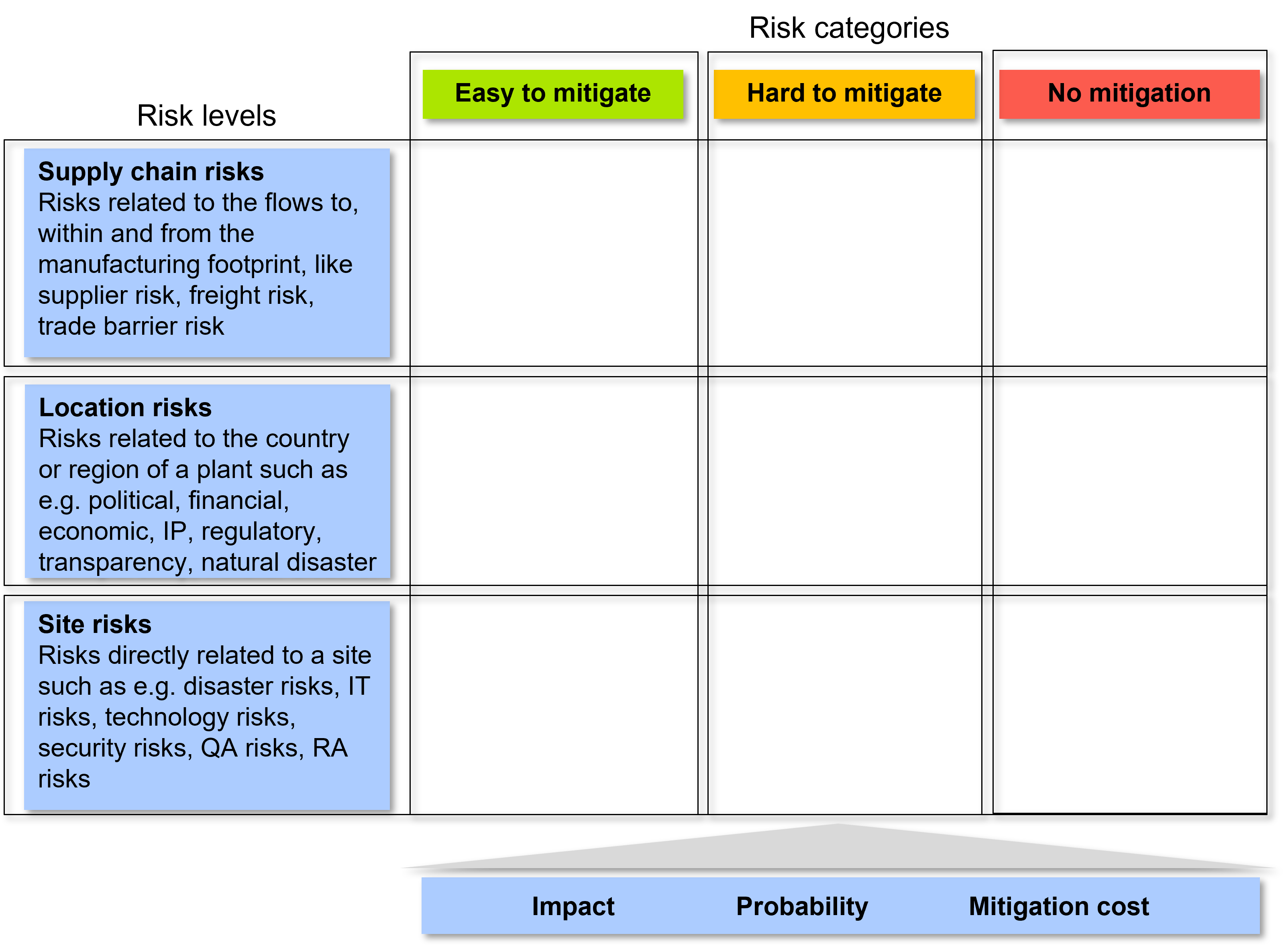

In all strategic initiatives covered so far risk is one of the drivers for companies to take a different approach. In order to deploy effective risk management and to take risk into account in an integral way when modelling manufacturing footprint scenarios, companies first must get a good view on what risks are relevant and then determine how to balance those risks against the typical drivers such as costs, lead times, etc.

Besides this, companies must also work on putting a structure in place to deal with these risks in practice. A good benchmark here can be the leading global high tech companies who have created virtual internal organizational units that are continuously monitoring the company’s manufacturing footprint and supply chain (system-driven dashboards) and are taking action the moment a risk event is identified with the aim of solving the issue before it can even start to harm the continuity of the supply chain.

Source: BCI Global, 2021

Now companies are taking a more long-term strategic perspective again, there clearly is a need across industry verticals to increase the resilience level in global manufacturing footprints. BCI Global has defined 5 strategic initiatives that companies should include in their overall manufacturing footprint strategy development: