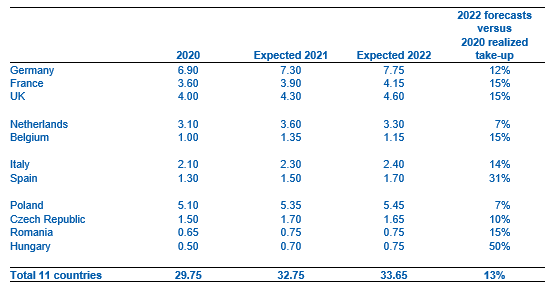

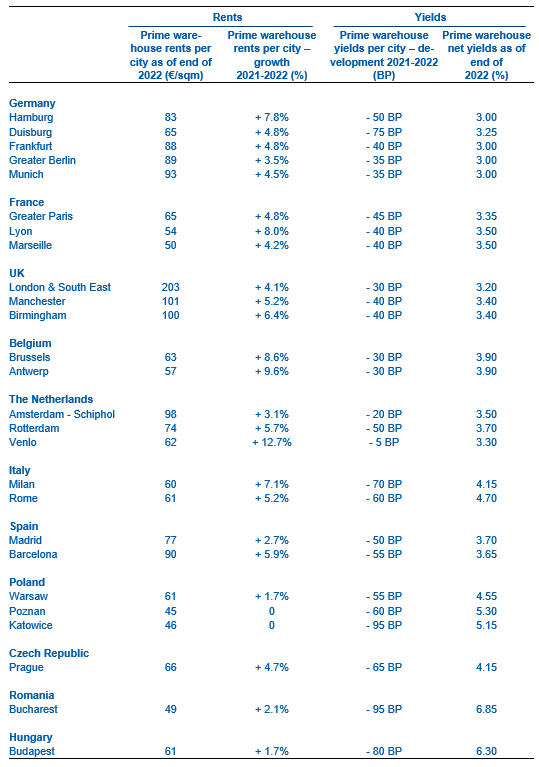

The European logistics market has grown last year with a record number of 10% and a further growth of the take-up to nearly 34 mln sqm is expected for this year. The logistics markets in the UK, Germany and France are still hot, not only from a tenants perspective (high take-up), but also from an investor perspective as yield compression continues and yields are expected to decrease with 40 basis points.

These are the conclusions of Buck Consultants International, based on a survey amongst Europe’s most important logistics real estate developers, investors and experts.

“The results show that Covid-19 has not impacted the logistics real estate take-up volumes across Europe. The fast growth of e-commerce and the build up of more inventory to cope with supply chain disruptions favor the growth of warehousing”, says René Buck, CEO of Buck Consultants International.

Logistics real estate is seen by nearly all interviewed developers and investors as a strong asset class, with a lot of interest of non-European investors. So, yields are decreasing and yield compression continues.

Source: Buck Consultants International, 2022

Source: Buck Consultants International, 2022

The BCI study reveals that 54% of the interviewed experts expect that the establishment of new mega distribution centers (more than 40,000 sqm each) will grow with at least 10% with Germany, Poland and the Netherlands as most favorite locations. In some countries lack of supply is impacting the growth of logistics real estate (for example The Netherlands). The logistics real estate industry is divided over the question whether it is understandable that pertinent authorities across Europe want to stop the growth of mega distribution centers: 50% agrees, 50% disagrees.

The expected growth of new city distribution centers in 2022 (city hubs, last mile hubs) is spectacular as 92% of the interviewees expect a growth of at least 10%; London, Paris and Berlin are seen as best cities for city distribution centers.

“Lack of warehouse personnel is becoming an important hurdle for further growth of the logistics sector and related logistics real estate”, explains Johan Beukema, partner at Buck Consultants International. “In many hotspot logistics regions demand for labor is high. The number of vacancies for logistics jobs breaks records. There are three solutions to this: being an attractive industry to work in, look for migrant workers and accelerate automation and robotization.”